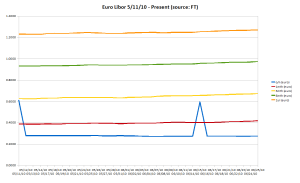

For reasons I’ll explain in a bit, this is going to be a critical week for Libor funding. But before I get to that, I want to recap what has happened in the Libor markets this past week. So let’s take a look at the usual suspects charts:

The kink between the 6mth and 1yr Dollar Libor maturities is flattening a touch.

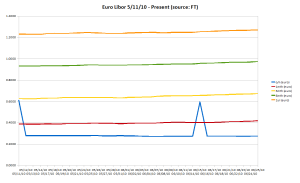

Meanwhile, Euro Libor is shifting out. Noticeably.

As for Yen Libor, well, just leave it alone. It’s sleeping so soundly I don’t want to wake it.

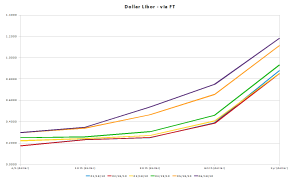

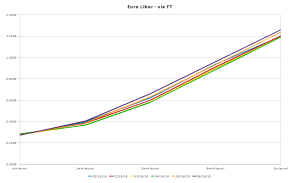

But let’s take a look at some weekly snapshots of the Dollar and Euro Libor curves:

Dollar Libor is relaxing some. Not that it’s relaxing that much, but the acute funding pressure we had seen building has softened a bit. This shouldn’t surprise us as this move coincides with the Euro move to the upside. Here I show the hourly chart going back two weeks. This should tell the story well enough:

Which also shows up in Euro Libor:

What we’re starting to see is a kink formed at the one month point on the curve. Mid-dated Euro funding is getting bid up while overnight funding remains dormant. This next chart shows that:

Outside of the two hiccups 35 days apart, that is.

But now, things get interesting. While I was on the road, zero hedge ran this post about funding conditions in Europe. I took this screen capture of the ECB’s OMO page:

I circled those two transactions because they settle within a day of each other. This week. So within 2 days, we’ll see almost €600bn in ECB reverse transactions settle. What is a reverse transaction? From the ECB’s General Documentation on Eurosystem Monetary Policy Instruments and Procedures:

Reverse transactions refer to operations where the Eurosystem buys or sells eligible assets under repurchase agreements or conducts credit operations against eligible assets as collateral.

So you can either structure these to take liquidity out of the system, or put it in. Trust me, these were injecting liquidity in to the system. But now they’re coming due, and I want to use this to show how inflation is not the issue to worry about and hasn’t been for a while.

How? Well, take a look at how much is now owed to the ECB:

For the small facility on 6/30:

(€151.5114bn)[1+((7/360)(1%))] = €151.5409bn

For the large facility due on 7/1:

(€442.2405bn)[1+((371/360)(1%))] = €446.7980bn

In a world where credit costs are minimal (extremely low default rates, good recoveries on collateral, charge-offs almost nil, etc.), this wouldn’t be an issue. Heck, the facilities wouldn’t have been this well-bid in a good credit environment. But we’re not in that kind of environment now and the credit cycle still has a ways to go before we can see a true recovery there. Plus, other assets like sovereign debt securities are having their own issues. Banks might hold some of these notes, so now you’re talking about a hit on the balance sheet again with the recent credit market action, in addition to the rising credit costs. Oh, and I forgot to mention falling loan demand. So amidst this backdrop, banks are going to have to come up with this cash.

And to make matters worse? Consider Spain:

Spain faces a confluence of events in July, whereby it will need to finance 21.7 billion euros within a single month. This combines shortfalls in its budget and a wave of scheduled government debt redemptions.

via Spain’s Debt Maturity Wave Hits Next Month And It’s Already Obvious They Don’t Have Enough Cash.

The problem here is two-fold: first, there are the questions about what the cost will be – i.e. how much will the spread to German bunds be. Second, consider this (emphasis mine):

It goes without saying that the government’s priority will be smooth and well-bid auctions (see calendar below), with local banks playing a crucial role.

So Goldman obviously expects banks to be bidding on these notes. Below is the Spanish debt auction calendar in question:

The 5yr bond auction takes place the same day the monster ECB facility expires. Can this get any crazier, or what?

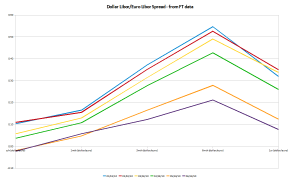

Looks like the Euro Libor market is becoming less and less certain, of well, a lot. Take a look at the spread term structure:

Dollar/Euro Libor spreads are widening a bit, but not for the right reasons. It seems now that the increases in the term structure of Dollar/Euro Libor spreads are being driven by uncertainty over the June 30/July 1 settlements. Given the nature of the activtiy in the funding markets, I’ll probably write something before next week on this (i.e. look for a post later in the week as we approach month end).

Because as of right now, this like driving in a foreign country where no streets are named, numbered and there are no traffic lights or signs.

But the sad thing is, we’re not driving. We’re standing in the middle of the intersection while everyone converges from all 4 directions at death-defying speed.

There’s only one way I can see this ending “well.” The ECB will have to announce a new facility to roll all of the collateral that has been pledged and the banks can keep the Euros the ECB lent them. For now, anyway. But there has been no indicator they’re working on this.

Better find something to hold on to and brace for impact…